Woman In Austria Destroys Cash To Prevent Inheritance

Florida residents who are working on an estate plan may be interested to learn that a woman in Austria destroyed the equivalent of more than $1 million in cash in an effort to disinherit her heirs. However, it is much more difficult to disinherit family in Austria than in the United States, and the country’s […]

Importance Of Estate Planning For High-Asset Estates

Florida residents who have significant assets should avoid making the same estate planning mistakes that late actor James Gandolfini did with his own. When Mr. Gandolfini died in 2013 at age 51, he did so without having adequately planned for how his assets would pass to his heirs. Mr. Gandolfini’s estate was worth $70 million […]

Estate Closing Letters Must Now Be Requested From The IRS

A change in procedures by the Internal Revenue Service could cause delays for beneficiaries of estate assets in Florida. Previously, the IRS would automatically send a closing letter to an estate executor after they had filed Form 706. Once the closing letter was received, the estate executor could begin dispersing the remainder of the estate’s […]

When Life Changes May Necessitate Amending Trusts

As the use of trusts for estate planning has become increasingly common, more and more Florida residents have drawn up the documents necessary to establish them. In some cases, a change in circumstances may necessitate an update or amendment to the trust document itself. Determining when such a change is needed may be tricky for […]

A Totten Trust Provides Privacy

Florida residents who are working on an estate plan may want to consider a Totten trust if they want to avoid making a will or going through the probate process. With a Totten trust, a person opens a bank account and makes deposits for a beneficiary. The person is able to withdraw money from the […]

Reviewing And Revising Trusts

Florida residents who are using trusts as a part of their estate plan may want to change those trusts in light of new laws. Since 2013, federal income tax laws have changed so that the highest marginal rate is at a far lower adjusted gross income threshold for trusts than it is for individuals. As […]

Importance Of Estate-Planning Documents

A large number of Floridians put off planning their estate. When people do not plan, they can leave a lot of disorganization behind for their family members. There are some specific documents that are necessary to have in place in order to avoid confusion. When a person owns property jointly, that property will automatically pass […]

Benefits Of A Family Trust In Florida

In 90 percent of high-net-worth families, most or all of that wealth is gone by the third generation. In some cases, the wealth is eroded because of capital gains and transfer taxes in addition to how assets are divided among the generations. Wealth can also be eroded through the generations because of a variety of […]

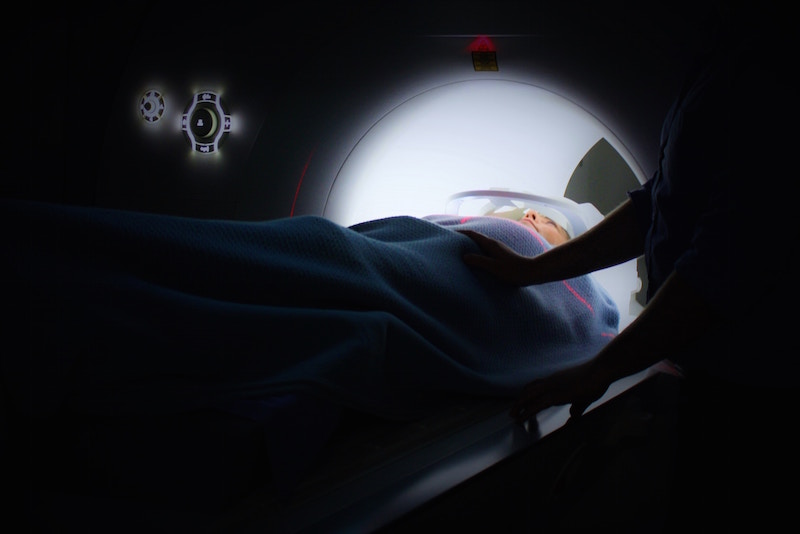

Understanding Health Care Advance Directives

Florida residents who are planning their estate might be interested in learning about health care advance directives. Besides expressing a person’s wishes for medical care in the unfortunate event they cannot speak for themselves because of a serious injury or illness, these legal documents have several other benefits, too. When it comes to long-term health […]

Many New Roles, Options For Trusts

People in Florida who are setting up trusts as part of their estate plan may be surprised to learn that these types of instruments have become much more intricate over the years. For example, there are new roles and positions possible in irrevocable trusts that were largely not used in the past. In general, trusts […]